child tax credit 2021 eligibility

The amount you can get depends on how many children youve got and whether youre. The remaining half of the credit for e.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

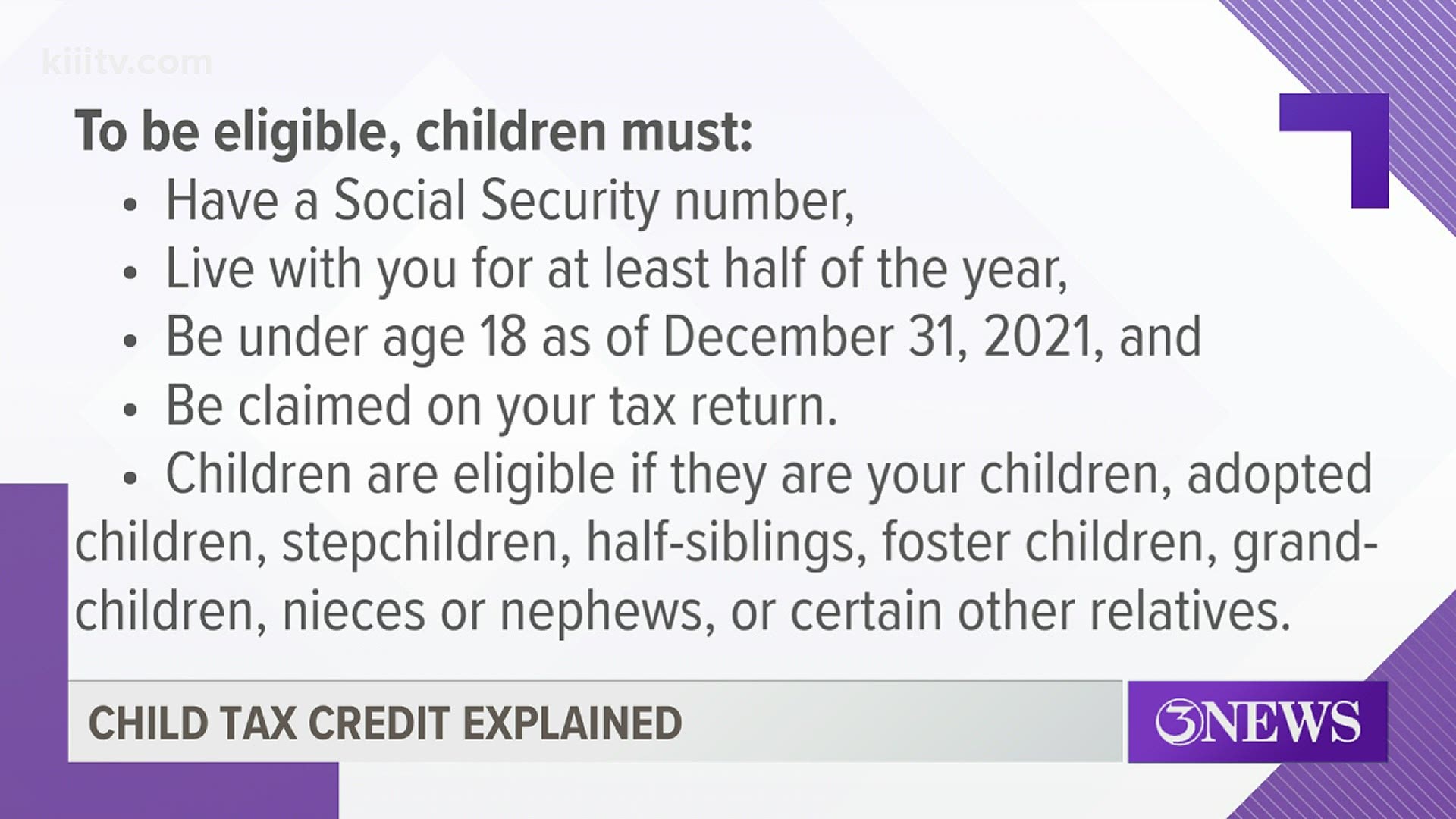

For 2021 a legal dependent who is age 17 or younger as of december 31 2021 can qualify for the child tax credit.

. Eligible taxpayers who did not receive advance Child Tax Credit payments last year can claim the full credit by filing a 2021 tax return. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child. Child tax credit 2021 eligibility.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Parents with children aged 17 years or under are mostly eligible for the new child tax credit. Taxpayers can now claim a credit of 3000 for every dependent child between the.

Grandparents foster parents or people caring for siblings or other relatives should check their eligibility to receive the 2021 child tax credit. The ARP also enhanced. It also provides the 3000 credit for 17-year-olds.

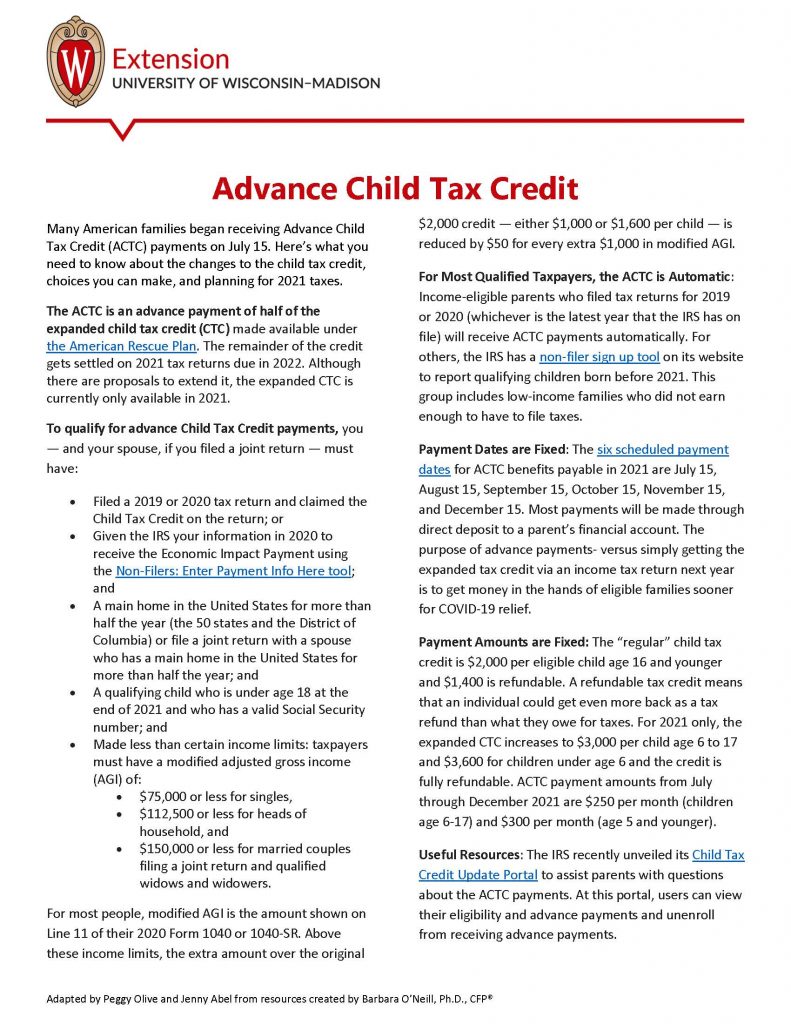

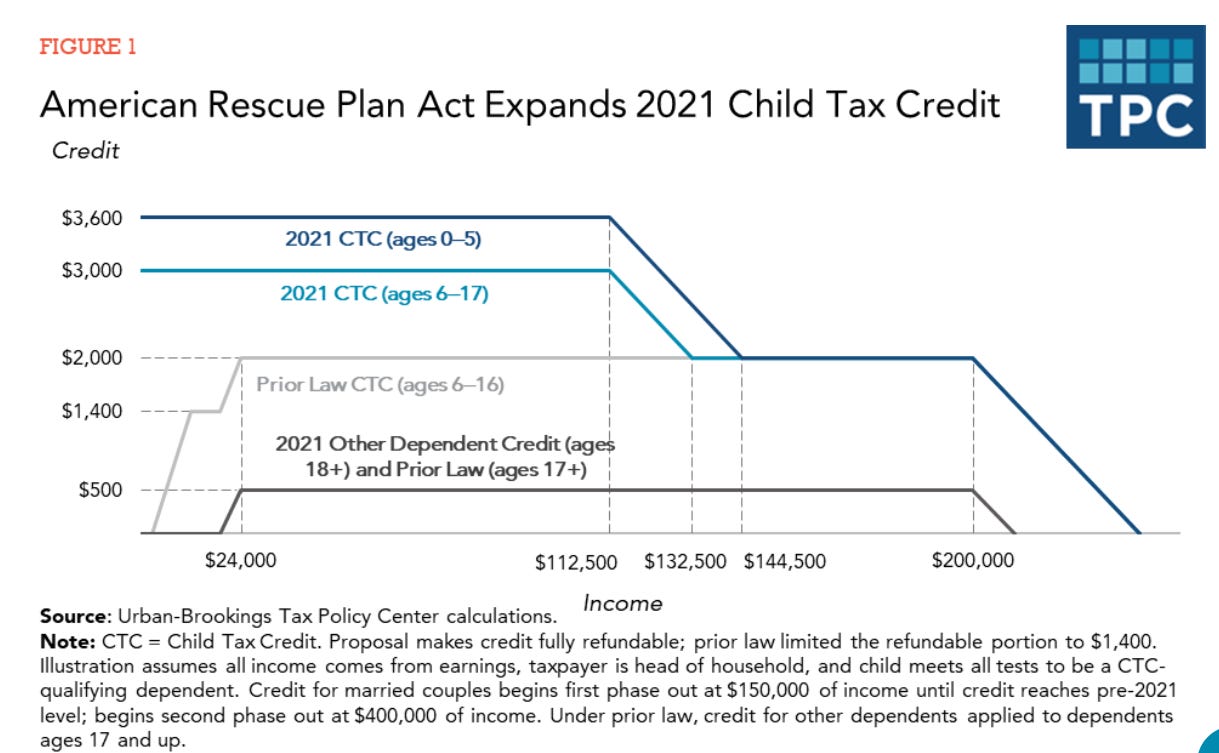

The American Rescue Plan ARP temporarily expands the Child Tax Credit CTC from 2000 per child to as high as 3600 for the 2021 tax year. Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. People who claim at least one child as their.

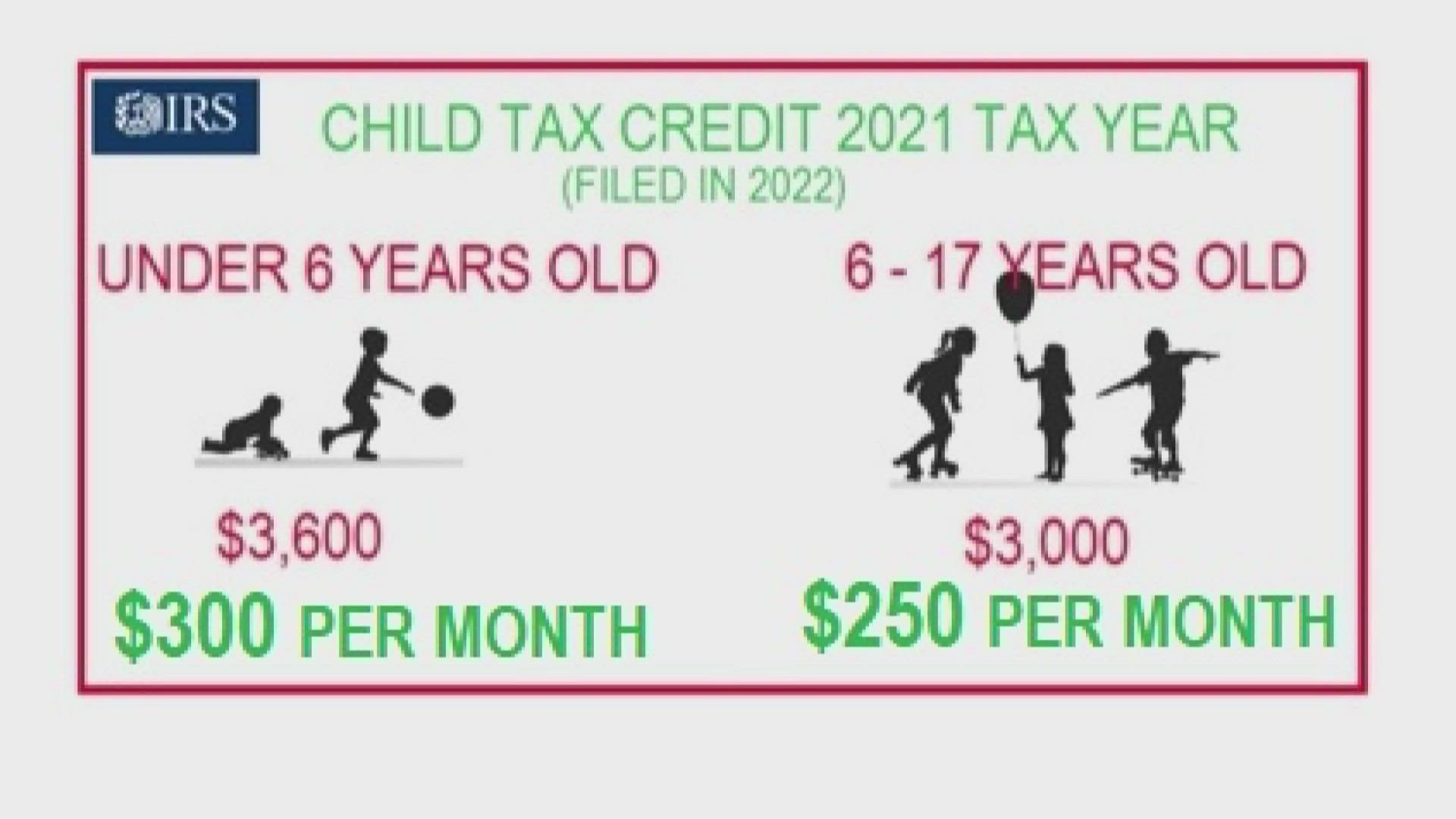

The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. Up to 3000 for each qualifying child ages 6 through 17. For example only couples making less than 150000 and single parents also called Head of Household making less than 112500 will qualify for the additional 2021 Child Tax Credit.

For each disabled child. Parents with children aged 5 and younger can qualify for a 300 monthly child and. How 2021 is Different.

3000 for children ages 6. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Similarly for each child age 6 to 16 its increased from 2000 to 3000.

For each child this is known as the child element Up to 2935. Under the American Rescue Plan the IRS disbursed. Only available if you arent required to file a 2021 tax return usually earning less than 12500 single or 25000 married File for the Child Tax Credit EITC and the 2021 stimulus payments.

The American Rescue Plan Act changed the tax credit for just one year. Already claiming Child Tax Credit. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

You may have received up to half of this. Filed a 2019 or 2020 tax return and claimed the Child Tax. For 2021 eligible parents or guardians can receive up to 3600 for each child who.

The IRS urges grandparents foster parents or people. Starting july 15 families will. Child Tax Credit.

150000 if you are. Child Tax Credit will not. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Up to 3600 for each qualifying child ages 5 and under. Making a new claim for Child Tax Credit.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying. 3600 for children ages 5 and under at the end of 2021. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17.

With the IRS now sending advanced monthly payments of the 2021 Child Tax Credit CTC to qualified families its important to know the details of this federal benefit and whether it makes. The basic amount this is known as the family element Up to 545.

Irs Online Child Tax Credit Eligibility Tool Now Available In Spanish Larson Accouting

Advance Child Tax Credit Financial Education

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Eligibility Kiiitv Com

Arpa Expands Tax Credits For Families

Universal Cash For Kids Pays Off By Claudia Sahm

How To File For The Advance Child Tax Credit Payments In Milwaukee

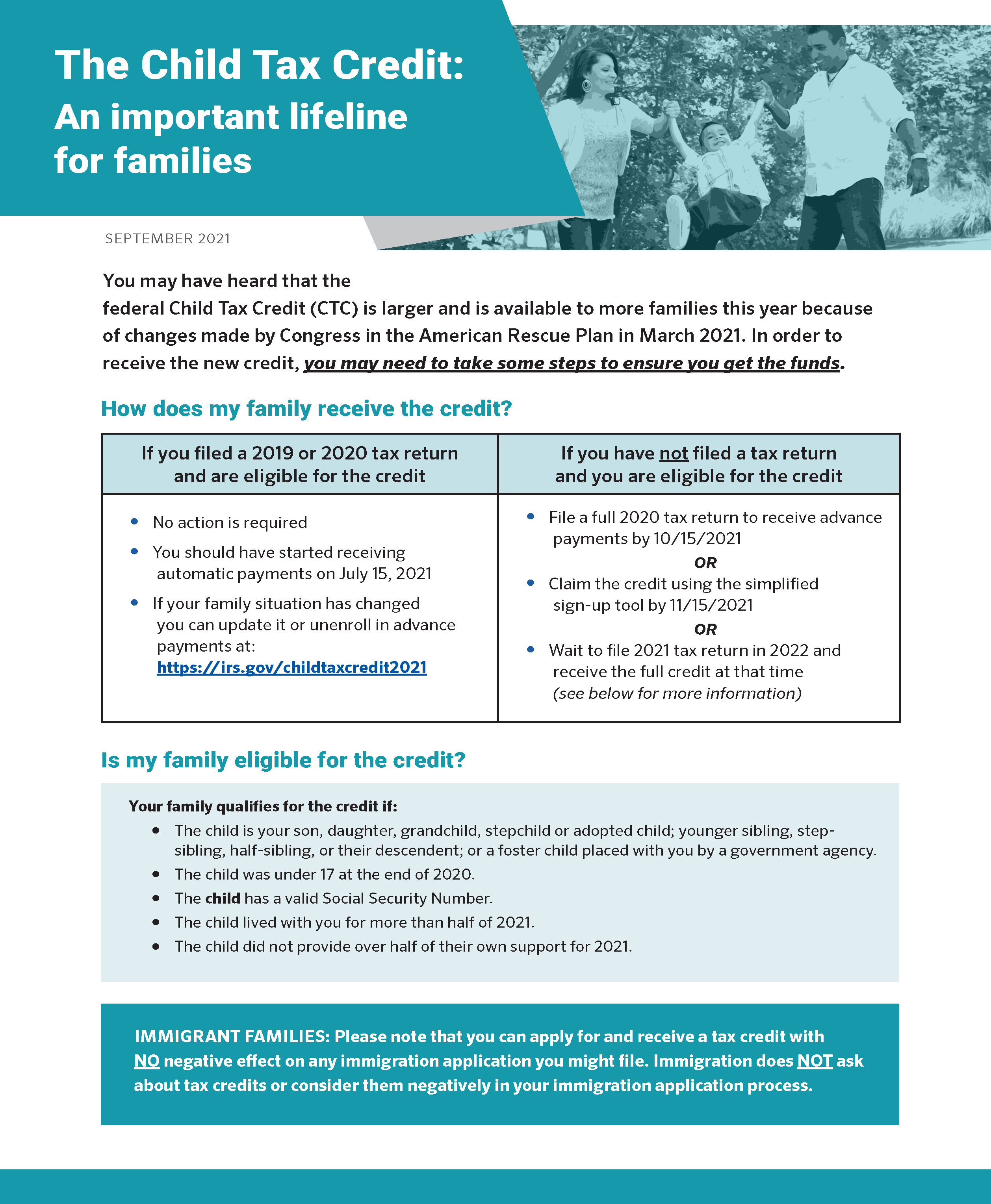

The Child Tax Credit An Important Lifeline For Families North Carolina Justice Center

Child Tax Credit What We Do Community Advocates

2021 Advanced Child Tax Credit What It Means For Your Family

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Infographic Child Tax Credit Keeps Millions Of Children Out Of Poverty Children S Defense Fund

Feds Launch Website To Claim 2nd Half Of Child Tax Credit Ktla

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Who Is Eligible For The Expanded Child Tax Credit Snopes Com

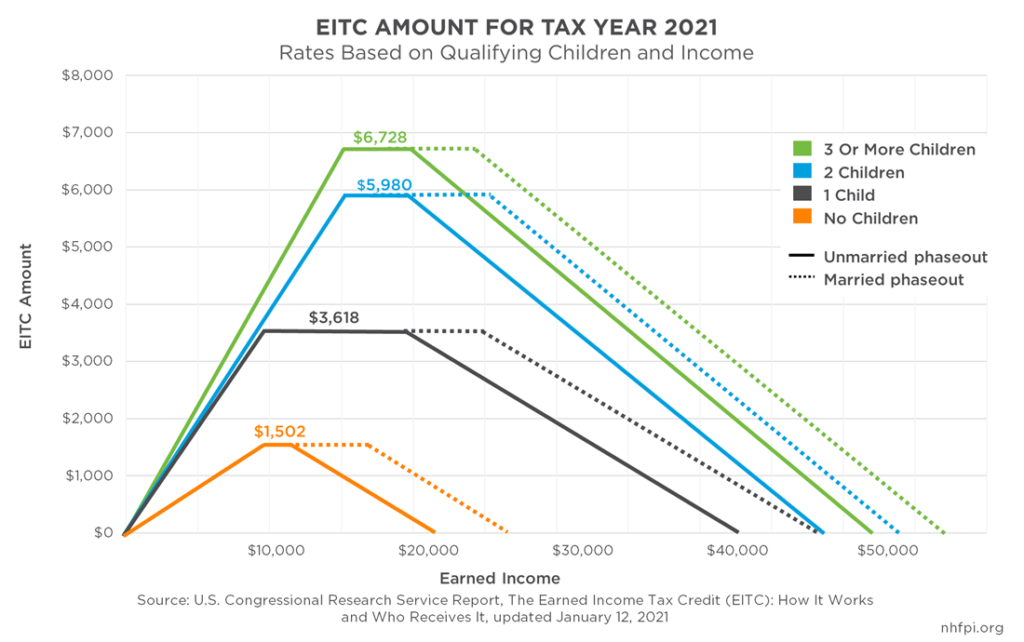

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

Child Tax Credit Children 18 And Older Not Eligible Verifythis Com

2021 Child Tax Credit Bank And Community Toolkit Bank Policy Institute

Millions Of Families Received Irs Letters About The Child Tax Credit