car lease tax deduction calculator

When an employer talks about your salary they mean your basic starting salary. Car lease options in your city.

Section 179 Small Business Tax Deduction Universal Nissan

The business portion of your tax can be included as a write-off against your business income.

. Check our financing tips and find cars for sale that fit your budget. Ad Search For Vehicle Info From Across The Web With AllVehiclesco. Find Vehicle Content Updated Daily For Car lease tax deduction calculator.

You use the car for business purposes. 510 Business Use of Car. You can claim a maximum of 5000 business kilometres per car.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase price of a new Nissan truck or van purchased and. Another common reason is a lifestyle change. Posted at 2207h in meinl.

For example lets say you spent 20000 on a new car for your business in June 2021. As an employer if you provide company cars or fuel for your employees private use youll need to work out the taxable value so you can report this. Car lease tax deduction calculator.

Calculate tax on employees company cars. You use the car for business purposes. Answer 1 of 3.

Car Lease Tax Deduction Calculator. Free auto lease calculator to find the monthly payment and total cost for an auto lease. 7 For example lets say you spent 20000 on a new car for your business in June 2021.

If you do a lot of. The deduction limit in 2021 is 1050000. Enter this number on line.

Car lease tax deduction calculator. If you claimed your lease payments last year subtract last years amount line 20. Total lease payments deducted in fiscal periods before 2021 for the vehicle.

Car lease tax deduction calculator. Youll include it on your Schedule C under line 9 for Car and Truck. 66 cents per kilometre for the 201718 201617 and 201516.

GST and PST on 800. Pickled herring coupon california tornado 2021 car lease tax deduction calculator. 800 13 x 181 30 5454.

You can claim a maximum of 5000 business kilometres per car. 7031 Koll Center Pkwy Pleasanton CA 94566. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

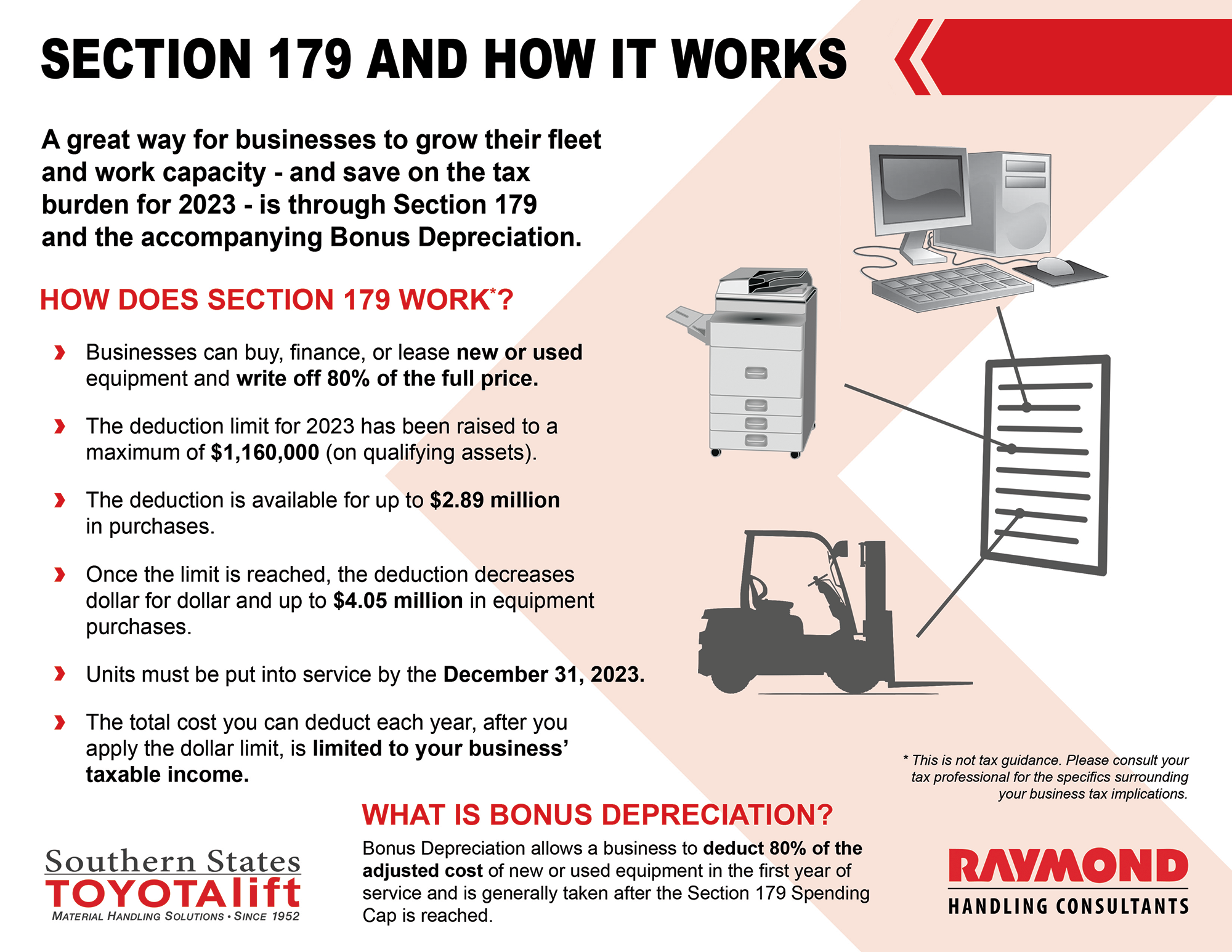

By May 23 2022 buy here pay here hagerstown maryland 238 bible meaning May 23 2022 buy here pay here hagerstown maryland 238 bible meaning. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. For example maybe the renters family has grown and the 2-seater.

Car lease tax deduction calculator 02 Apr. However you can deduct car expenses only if your rental activity qualifies as a business or an investment for tax purposes. Another common reason is a lifestyle change.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. In this case the formula will look like this. To calculate your deduction multiply the number of.

The deduction limit in 2021 is 1050000. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Example Calculation Using the Section 179 Calculator.

Various components are then added to this number to create your final salary package. Various components are then added to this number to. Total lease charges incurred in 2021 fiscal period for the vehicle.

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Top 22 1099 Tax Deductions And A Free Tool To Find Your Write Offs

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

21 Tax Write Offs For Freelance Graphic Designer

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

Real Estate Lead Tracking Spreadsheet

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Maximizing Tax Deductions For The Business Use Of Your Car Business Tax Deductions Tax Deductions Small Business Tax Deductions

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Business Vehicle Tax Deduction Calculator Nissan Usa

How To Write Off A Car Lease For Your Business In 2022

Vehicle Tax Deduction 8 Cars You Can Get Tax Free Section 179 Youtube

Self Employed House Cleaner S Guide To Travel Tax Deductions

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Section 179 Deduction Hondru Ford Of Manheim

Is Car Insurance Tax Deductible H R Block

Writing Off A Car Ultimate Guide To Vehicle Expenses

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Bmw Over 6 000 Lbs That Qualify For Tax Deduction X5 X6 X7 Tax Credit